Cheryl McCloud, USA TODAY NETWORK - Florida

Updated ·4 min read

The 2024 Atlantic hurricane season is officially underway.

If you haven't already started building — or restocking — your hurricane kit, now is a perfect time.

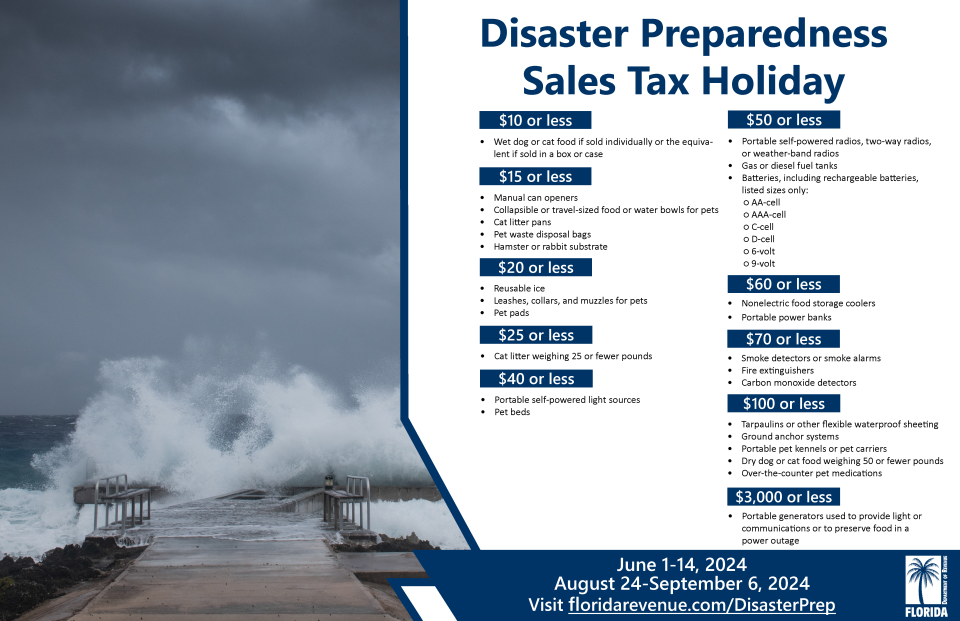

Florida's disaster preparedness sales tax holiday also started today, and you can avoid sales tax on specific supplies for the next 14 days.

➤Tropics watch, May 30: NHC tracking 4 tropical waves

A second 14-day sales tax holiday will start in August, just in time for the peak of hurricane season.

Forecasters have been warning for months the 2024 season will be hyperactive, with what could be more than double the average number of storms.

When is the Florida hurricane tax free supplies holiday in 2024?

There are two,two-week sales tax holidays in 2024 to help residents prepare for disasters.

The 2024 holidays are:

June 1-June 14

Aug. 24-Sept. 6

Generators, portable or standby? Looking to buy a generator? From types to cost, here are 7 things you should know

Building your hurricane kit: What emergency supplies are tax free?

Eligible items included in the tax-free holidayinclude:

A portable generator used to provide light or communications or preserve food in the event of a power outage with a sales price of $3,000 or less.

A tarpaulin or other flexible waterproof sheeting with a sales price of $100 or less.

An item normally sold as, or generally advertised as, a ground anchor system or tie-down kit with a sales price of $100 or less.

A smoke detector or smoke alarm with a sales price of $70 or less.

A fire extinguisher with a sales price of $70 or less.

A carbon monoxide detector with a sales price of $70 or less.

A nonelectric food storage cooler with a sales price of $60 or less.

A portable power bank with a sales price of $60 or less.

A gas or diesel fuel tank with a sales price of $50 or less.

A portable self-powered radio, two-way radio, or weather-band radio with a sales price of $50 or less.

A package of AA-cell, AAA-cell, C-cell, D-cell, 6-volt, or 9-volt batteries, excluding automobile and boat batteries, with a sales price of $50 or less.

A portable self-powered light source (powered by battery, solar, hand-crank, or gas) with a sales price of $40 or less, including: flashlights, lanterns and candles.

Eligible light sources and radios qualify for the exemption, even if electrical cords are included in the purchase.

Reusable ice (ice packs) with a sales price of $20 or less.

➤Full list of items exempt from sales tax

Save money on pet supplies during sales tax holiday

Supplies needed for the evacuation of household petsare included in the disaster preparedness sales tax holiday. Necessary supplies means the noncommercial purchase of:

Bags of dry cat or dog food weighing 50 or fewer pounds and with a sales price of $100 or less per bag.

Portable kennels or pet carriers with a sales price of $100 or less per item.

Over-the-counter pet medications with a sales price of $100 or less.

Pet beds with a sales price of $40 or less per item.

Cat litter weighing 25 or fewer pounds and with a sales price of $25 or less per item.

Leashes, collars, and muzzles with a sales price of $20 or less per item.

Pet pads with a sales price of $20 or less per box or package.

Manual can openers with a sales price of $15 or less per item.

Collapsible or travel-sized food bowls or water bowls with a sales price of $15 or less per item.

Cat litter pans with a sales price of $15 or less per item.

Pet waste disposal bags with a sales price of $15 or less per package.

Hamster or rabbit substrate with a sales price of $15 or less per package.

Cans or pouches of wet dog food or cat food with a sales price of $10 or less per can or pouch or the equivalent if sold in a box or case.

Is there a limit on the number of items that can be purchased during the sales tax holiday?

No.There is no limiton the number of qualifying items that can be purchased tax exempt.

Are disaster supplies purchased online tax free?

Yes. Items purchased by mail order, catalog, oronline are exemptwhen the order is accepted by the company during the sales tax holiday for immediate shipment, even if delivery is made after the tax holiday.

2024 is expected to be extremely active hurricane season

Every prediction issued for the 2024 Atlantic hurricane season has agreed: this season will be very active. Most forecasts call for more than double the average number of storms.

TheNational Hurricane Center released its season predictionsThursday, May 23. The agency is predicting 17-25 named storms, eight to 13 hurricanes and four to seven major hurricanes.

How many could hit Florida? Colorado State University forecasters looked at hurricane tracks from 1880 to 2020 and predicted there's a96% chance Florida could be impacted by a named storm in 2024.

This article originally appeared on Treasure Coast Newspapers: Save money tax free hurricane supplies as 2024 hurricane season starts